EViews 8 New Econometrics and Statistics: Estimation

EViews 8 new estimation features include Switching Regression (including Markov Switching), Bayesian VARs, Robust Least Squares, Breakpoint Regression, Heckman Selection, and Panel Cointegration.

Switching Regression

EViews 8 now estimates single-equation switching regression models—linear regression models with nonlinearities arising from unobserved discrete changes in regime, including models with independent and Markov switching. EViews also offers tools for filtering, smoothing, and forecasting from your estimated equation.

Dynamics specifications are permitted through the use of lagged dependent variables as explanatory variables and through the presence of auto-correlated errors (Goldfeld and Quandt, 1973, 1976; Maddala, 1986; Hamilton, 1994; Frühwirth-Schnatter, 2006).

For more details on Switching Regression, see our switching regression examples.

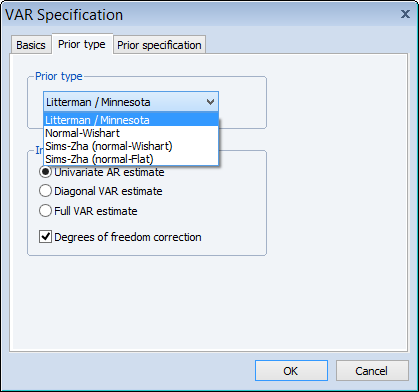

Bayesian VARs

EViews 8 now estimates Bayesian Vector Autoregression (BVAR) models which, as the name suggests, employ Bayesian methods to estimate a vector autoregression (VAR). EViews supports four different prior specifications on the parameters:

- Litterman/Minnesota prior.

- Normal-Wishart prior.

- Sims-Zha Normal-Wishart prior.

- Sims-Zha Normal-flat.

to provide shrinkage (restrictions on parameters to reduce the size of the parameter set) over the unrestricted least squares VAR estimates.

For more details on Bayesian VARs, see our Bayesian VAR example.

Robust Least Squares

EViews 8 supports robust least squares regression methods designed to be robust, or less sensitive, to outliers. EViews offers three different methods for robust least squares: M-estimation (Huber, 1973), S-estimation (Rousseeuw and Yohai, 1984), and MM-estimation (Yohai 1987).

For more details on Robust Regression, see our robust regression examples.

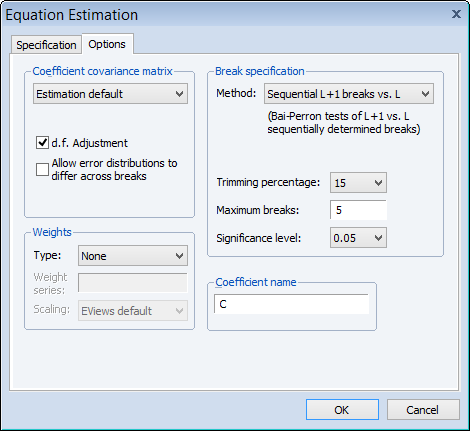

Breakpoint Regression

EViews 8 offers new tools for estimating linear regression models that are subject to structural change. The regime breakpoints may be known and specified a priori, or they may be estimated using the Bai (1997) and Bai and Perron (1998), global maximizer or sequential methods, and related techniques. You may estimate “pure” breakpoint specifications in which all of the regressors have regime specific coefficients, or specifications in which only some coefficients vary with the regime.

For more details on Breakpoint Regression, see our breaking regression examples.

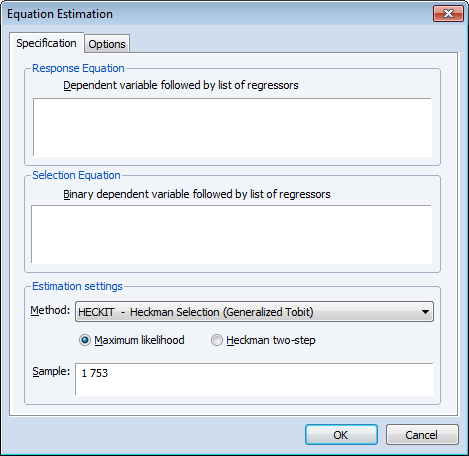

Heckman Selection Models

Under the Heckman selection framework, the dependent variable, yi in a linear regression model is only observable for a portion of the data. A classic example, in economics, of the sample selection problem is the wage equation for women, whereby a woman’s wage is only observed if she makes the decision to enter the work place, and is unobservable if she does not. The resulting selectivity bias implies that ordinary least squares is no longer an appropriate estimator.

EViews 8 offers two different methods of estimating the Heckman (1979) least squares model with sample selection: Heckman’s original two-step method, and maximum likelihood estimation.

For more details on Heciman Selection models, see our examples.

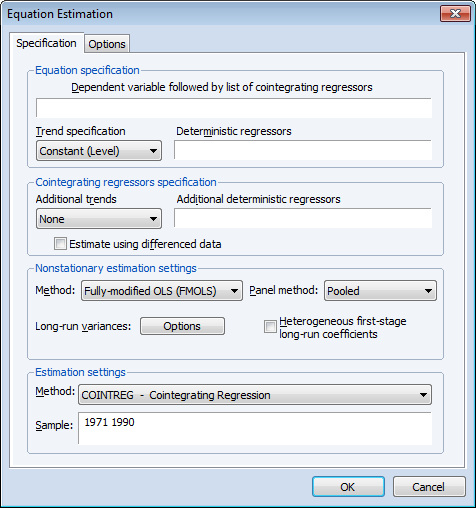

Panel Cointegration Estimation

EViews 8 now offers tools for estimation of single equation panel cointegration estimators. You may estimate your specification using the Fully Modified OLS (FMOLS) panel estimators outlined by Pedroni (2000), or the panel dynamic ordinary least squares (DOLS) estimators described by (Kao and Chiang, 2000; Mark and Sul, 2003).

For both classes of estimators, EViews offers the pooled and weighted forms of the estimators, which combine data across cross-sections, and the grouped estimators, which combine across cross-sections, the estimates obtained for each cross-section.

For more details on Panel Cointegration, see our panel cointegration examples.

User-defined Optmization

EViews offers a wide variety of built-in estimation methods that involve optimization, including (but not limited to) those supported by the Equation, System, Sspace, and VAR objects.

In addition, the EViews Logl object lets you maximize user-defined likelihood functions, but the Logl object is restricted to computations that can be specified using series expressions, with a log-likelihood objective represented as a series containing log-likelihood contributions for each observation.

In contrast, the new EViews 8 optimize command provides tools that allow you to find the optimal parameters or control values of a user-defined function. Notably, optimize supports quite general functions so that the computations and the user-defined objective need not be series-based.